Bumper Harvest Expected to Dampen Maize Prices

By Kalata News

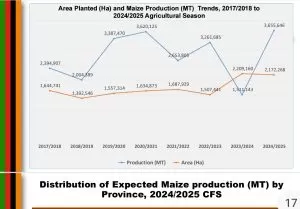

Lusaka, May 2025 – ZAMBIA is expected to harvest a record over 3.7 million metric tonnes of maize in the 2025 farming season, the highest that Zambia has over recorded, beating the 2021 maize harvest of 3.6 million metric tonnes.

According to the Ministry of Agriculture and Zambia Statistics (Zamstats) Crop Forecast for the 2024/2025 marketing season, the 2025 harvest will be double and a half (142 percent) of what the country had recorded during the drought, namely 1.5 million metric tonnes.

Most of the maize will be coming from Central province with 680 thousand metric tonnes, followed by Eastern Province with 536 thousand metric tonnes, then Copperbelt and Southern Province with 520 and 454 thousand metric tonnes respectively.

However Southern province led with the largest areas (hectares) cultivated followed by Eastern Province. The highest production per hectare came from the Copperbelt at 2.8 metric tonnes per hectare against the national average of 1.7 metric tonnes per hectare.

Most of this maize is being produced by small and medium scale farmers (at 93 percent) compared to 7 percent from commercial farmers.

This bumper harvest means Zambia will have a surplus of close to 500 thousand metric tonnes of maize which will be available for export or value addition.

The bumper harvest is expected to dampen the maize crop price due to increased supply of the commodity.

Farmers’ eyes will therefore be on the Food Reserve Agency’s maize purchase price, which normally sets the yardstick for the country’s commercial crop buying prices.

Last farming season, FRA purchased maize at K330 per 50kg bag. This price was a 17 percent increase from the K280 offered in 2023.

Due to reduced supply caused by drought and a maize shortage, some private buyers were even offering higher prices, reaching K350 to K400 per 50kg bag.

FRA Board Chairperson Suresh Desai in a press briefing to kick start the maize transportation and maize buying season at the FRA offices, said “We are expecting a large crop this year.”

He said FRA must ensure that the 2024/2025 crop marketing season goes on smoothly and that farmers, including those that help move the maize into storage facilities must be paid well and paid on time.

“FRA (staff and management) are working very hard to prepare for the crop marketing season. Previous season was a very bad one but because of the various interventions, no one died of hunger and there were no queues of villagers coming into town to look for maize. FRA made sure that maize was delivered to these villages.” Said Mr. Desai.

Mr. Desai said as part of preparations, the FRA has already distributed about 14 million empty sack bags in readiness for the season.

The FRA Board Chairperson said the storage capacity for the new crop for the 2025 season is about One million metric tonnes and so far about 14 thousand people have been employed ahead of the 2025 crop marketing season.

An economist Kapansa Sikazwe says given the favourable rainfall received during the current season, Zambia is expected to record a bumper harvest in 2025, this will obviously lead to an increase in the supply of maize on the market.

“If the law of demand and supply holds, the prices may decline. This is especially probable if the private buyers choose to take advantage of the abundance of maize to drive down their costs. On the other hand, FRA may choose to maintain or increase the maize price in order for them to easily purchase the targeted quantity and also encourage farmers to grow more maize. If this happens, then it’s a win for the farmers, as private buyers may also raise their prices to compete with FRA. The other possibility is for the private buyers to sit back and wait for FRA to exhaust its target, then swing in to purchase the remainder of the maize at a lower price. Alternatively, they can entice the sellers by providing spot cash, despite offering a price lower than that of FRA,” explains Sikazwe.

Frank Kayula, Executive Director at the National Association for Smallholder Farmers (NASFA) in Zambia says farmers should be allowed to make more dollars through maize exports to enable them to make more money from the bumper harvest.

He cautions that the Government must not use their fear of the drought to close borders after the FRA had finished its internal buying, saying farmers can only make good money by selling their maize abroad in the dollar market compared to the kwacha one.

“Farmers expect the price of maize to be between K300 to K400 per 50kg. If it is near K400 per 50kg bag or above, the farmers will be happy.” Said Dr. Kayula.

Price of Mealie meal

A Quarterly Market Bulletin under the Ministry of Agriculture, Department of Agribusiness and Marketing issued in March, 2025 observed that the prices of maize had continued at an average of 10 percent in the first quarter (January-March).

It stated that generally, prices of agricultural commodities are influenced by various market forces that have an effect on demand and supply. Many of these forces often arise from natural calamities such as floods, droughts, pest and disease outbreaks affecting yields and quality of agricultural products which often lead to an effect on the product price.

Others are Supply and Demand, when demand is higher than supply, prices increase, storage levels & transportation constraints.

Geographical location, availability and access of Market information and Seasonality (Inventories and stock levels) and Levels of stored commodities influence market supply and demand.

Maize fetched per metric tonne in the three months (January-March) at ZMK 8,560, 8,800 and 9,460 respectively.

Similarly, the price of maize meal went from ZMK per 25Kg from ZMK353 to ZMK302 in the first quarter.

Ruth Henson, a farmer based in the Southern town of Livingstone says, the maize market has been heavily under-priced for over 15 years in preference to pleasing the urban dwellers and the urban poor. She said the urban people expect the rural (farmer) to work for nothing.

“That is the problem that needs to be solved but don’t solve it on the backs of the farmers. A lot of the urban unemployment is in urban areas because urban poverty was better than rural poverty. If that changes many will move. It’s grossly unfair. If we consistently have a maize price above cost then the sufferers are the urban unemployed,” she said.

Ms Henson added, “Nobody with a salary should be complaining about the price of a bag of mealie meal. It’s still on the cheap side.”

Global Markets: International maize, wheat and rice prices increased in April 2025

Globally maize prices experienced a significant increase in April 2025, driven by factors like tighter US stock levels, changes in import tariffs, and increased demand for exports from Argentina and Australia. Regional variations in maize prices were also observed, with some areas experiencing higher prices due to supply constraints or other factors.

In East and West Africa, maize prices were high due to localized production shortfalls, currency depreciation, and conflict-related access constraints. In Southern Africa, tight domestic supply conditions pushed white maize prices to new record highs in some countries.

Among all major cereal prices, worldmaizeprices increased the most in April 2025. The benchmark United States of America (US No.2, Yellow, f.o.b.) maize prices led the increase, up 4 percent month‑on‑month. Tighter stock levels in the United States of America, following a downward revision to the stock estimate, and adjustments to the United States of America’s import tariff policies, including the exemption of Mexico, the leading destination of the United States of America’s maize exports, contributed to the upward price pressure. Argentina (Up River, f.o.b.) and Brazil (Paranagua, feed) prices also both increased, by 3 percent and 1 percent, respectively, influenced by the increase in the United States of America’s prices.

Globalwheatexport prices rose marginally in April 2025. Steady demand for exports from Argentina and Australia boosted Argentine (12%, Up River) and Australian (Eastern States, ASW) prices by 2 percent. The Russian Federation (milling, offer, f.o.b., deep-sea ports) quotations continued to firm slightly, up 1 percent month-on-month, due largely to tightening exportable supplies. By contrast, the benchmark United States of America (US No. 2, Hard Red Winter) values fell by 3 percent as sales slowed and crop conditions improved. Trade policy and macroeconomic uncertainties also weighed on market sentiment.

The FAO AllRicePrice Index averaged 104.9 points in April 2025, up 0.8 percent from March. Export quotations ofIndicarice followed mixed trends in major exporters in April. Progress of the secondary crop harvest and subdued demand led to price declines in Thailand, while in India, sales to African buyers sustained a mild increase in quotations of 25% broken rice. In Viet Nam, prices increased to three‑month highs, as seasonal downward pressure on prices diminished with thewinter‑springharvest approaching its end. In the United States of America, quotations of US No. 2, 4% moved little in April, amid generally quiet trading activities.

ends